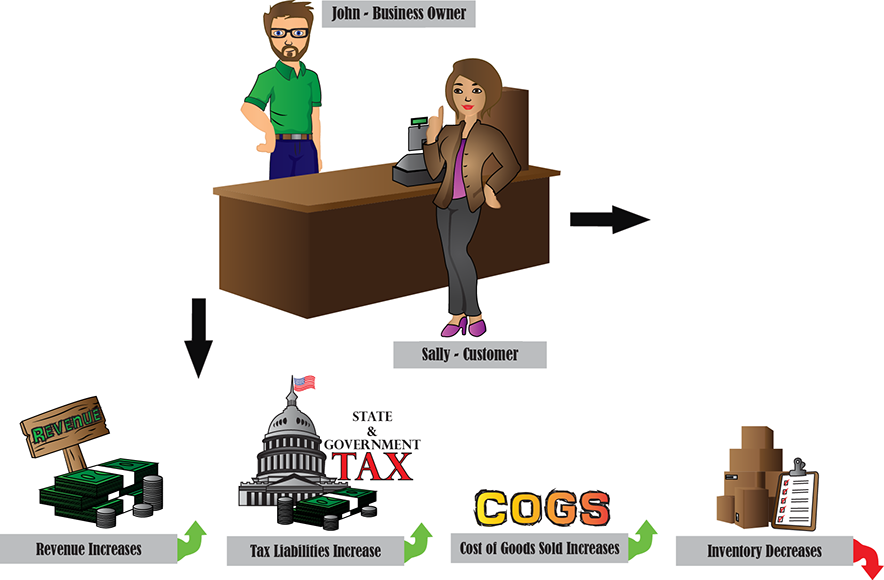

Selling Inventory

John sells his inventory to Sally. This decreases John's inventory (goods he has on hand). As a result of this transaction, John's revenue increases (money earned from the sale of the product). As a side effect of the sale, two other things happen. One, the “cost of goods sold,” or COGS, increases (what it cost John to purchase the inventory). Two, the amount of taxes owed also increases (state and federal tax liabilities).

Text

Company address

Adilas, LLC

517 Bake Street

Salida, CO 81201

You Dream It Up

We'll Wire It Up